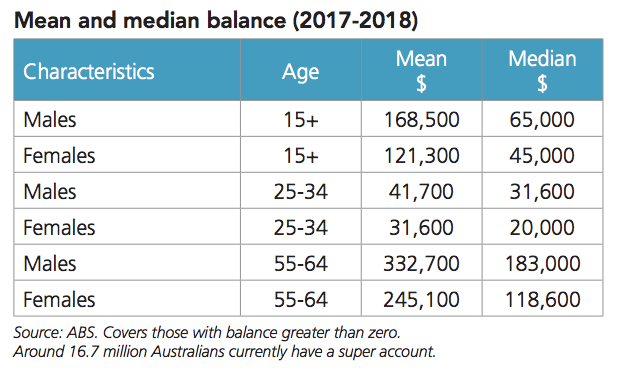

Turns out there’s about 3.1 trillion dollars collectively sitting in our super funds at the moment – that’s an average of $124,000 for each man, woman, and child in Australia. Of course, this money isn’t evenly distributed – the median is closer to $65,000 for males and $45,000 for females, though this increases to $183,000 and $118,600 respectively when you look at just the 55-64 age bracket:

Since 3.1 trillion is firmly in the ‘so much money it’s completely bonkers insane’ territory, here’s an amusing chart that’ll hopefully give you a little context. All numbers have been converted into AUD.

Nice to know that we could buy the world’s largest oil producer and nearly have enough left for a manned mission to Mars, eh?

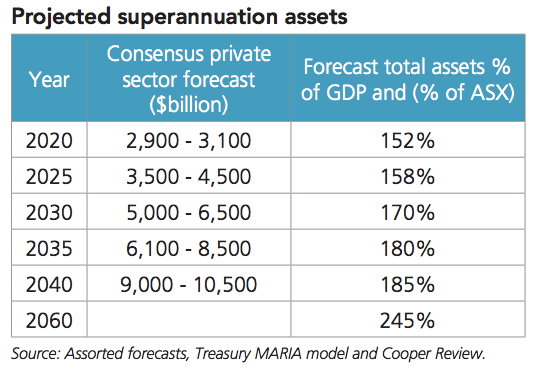

The crazy thing is that superannuation is just getting started, as the table below shows:

That’s right, in 2040 we’re expected to have a collective $10.5 trillion in our super funds.

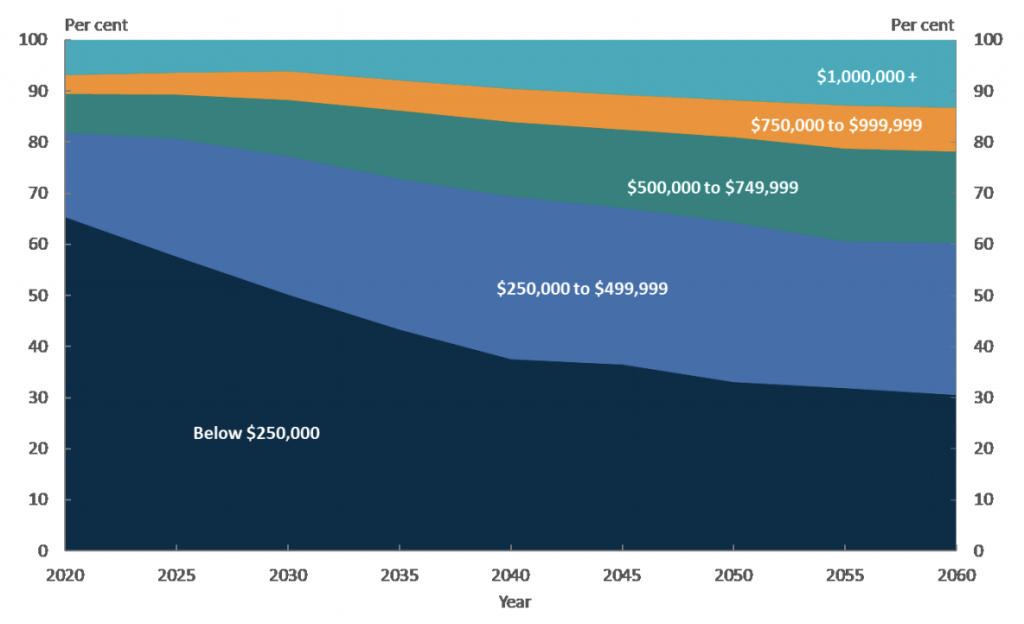

By 2060, it’s estimated that 70% of Aussies will be retiring with at least $250,000 in super, and 40% will have at least $500,000 (both figures are after accounting for inflation).

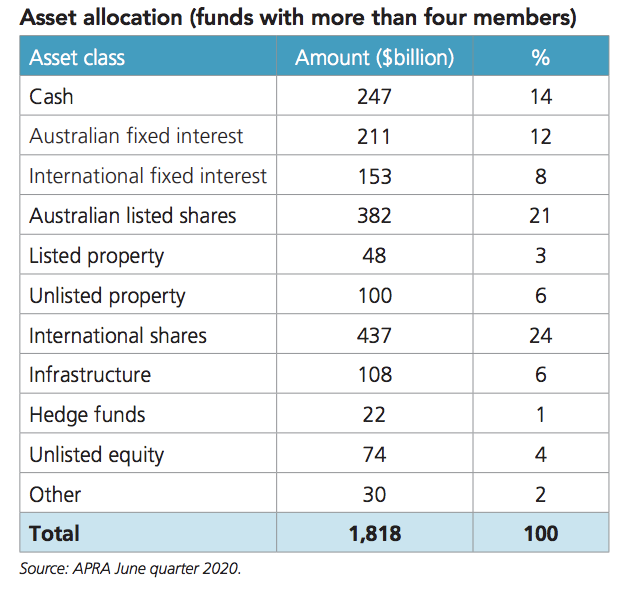

What’s interesting to note is that the vast majority of that money has to go somewhere before people reach retirement and start drawing it down; only a relatively small portion of it ‘sits in the bank’ – the rest of it is invested. Here’s a breakdown of how these funds are currently allocated:

Why is this important? Well, when you’re talking about investing amounts in the trillions of dollars, you start to move markets – even really big ones.

Take, for example, the arguably already overpriced Australian housing market, which as of September 2020 has a collective value of around 7.3 trillion dollars (source). What happens when hundreds of billions of super fund dollars flow into this market over the next 20 years looking for a return? Yeah, you guessed it – house prices go up. Again. Great if you’re already a home owner looking for those sweet sweet capital gains, but a real kick in the balls/ovaries if you’re not.

It’s partly for this reason that Norway’s sovereign wealth fund (the largest in the world with about 1.5 trillion AUD under management) isn’t allowed to invest within Norway itself – it would absolutely swamp the economy, and price Norwegian people out of their own markets.

As far as problems go, ‘having too much money’ is probably fairly low on most people’s lists, but it’s a problem nonetheless. Cashed up super funds that pile into the property market will make it even harder for Aussies to get a foot in the door, and will indirectly mean that much of the burden of funding retirees will fall on younger working Australians – which is exactly what compulsory superannuation was supposed to stop from happening.

If you enjoyed this article and would like to help me out, there are a few things you can do.

- I just created a Twitter account (I know, I know – bit late to the party). I promise to only post interesting things! Follow me here: https://twitter.com/LeaneJonathan

- If you have a spare couple of bucks, please consider joining my Patreon. As I said, I’d love to do this as a full time job, but at the moment I’d even settle for breaking even! I’ve set my Patreon up here: https://www.patreon.com/datamentary

- You could subscribe to my Youtube channel here: https://www.youtube.com/channel/UCiqE7AFojsc6U7fqmPt2Vdg

Youtube won’t let me monetise until I hit 2000 subscribers, so there’s still a looong way to go. - You could upvote this post on Reddit, share it on FB, etc… Really, any publicity I can get at this point would be a big help.

- And finally, if you have any requests for future topics or would like to collaborate on something, please leave a comment here and I’ll get in touch.

2 replies on “How we might end up accidentally pricing ourselves out of the property market”

Hi Jonathan,

Thank you for the article.

Your analysis fails to consider the composition of superannuation fund investments into property – ie the type of property that funds can buy.

Superannuation funds typically buy large investment grade commercial properties, sometimes via other fund managers (listed and unlisted).

Superannuation funds do not go out and buy individual houses or apartments. As you point out, they have billions to invest – not millions. The task of buying and managing thousands of smaller properties (such as residential properties) would be too burdensome.

There is however a growing trend in Australia towards the so called “build to rent” asset class, which is designed to allow institutional investors such as superannuation funds to own an apartment building with, say, 500 apartments in it. This would be an institutional grade residential property asset.

Previously, the tax regime (and on particular state land tax) made it difficult for institutions to compete with so called mum and dad investors in the residential sector.

As superannuation piles into local property, it will be your Collins Street or Martin place properties that are targeted. Perhaps an Amazon or bunnings logistics centre.

This will push other investors down the investment grade continuum to a degree, but it is not going to have a huge impact on residential prices in my opinion.

It will result in inflated prices for premium investment grade assets (that typically start at $20m+ and go all the way through to $billions for a single asset).

All the best

Hi Michael – great comment, thanks.

I agree with everything you’ve said, and, having done a bit more research into things I should amend the article. As you point out, the vast majority of superannuation funds being invested into the real estate market flow into commercial, not residential, real estate.

I hope you stick around and continue to comment 🙂